Venezuela is a key player in the global oil and gas market, holding the distinction of having the largest proven oil reserves in the world, with an impressive 304 billion barrels. This vast resource base significantly influences the national economy and presents substantial untapped potential. The government is proactively seeking foreign investment to modernize its energy infrastructure and expand production capacities. These efforts are geared towards reinforcing Venezuela's role as a major energy supplier, leveraging its extensive reserves to enhance its standing in the global energy arena.

Venezuela

Overview

Overview

Acquisition Highlights

New Stratus Energy has announced the acquisition of a 50% indirect interest in GoldPillar International. GoldPillar, in turn, holds a 40% equity stake in Petrolera Vencupet, S.A. Vencupet is the rights holder for oil production in six fields located in Eastern Venezuela.

-

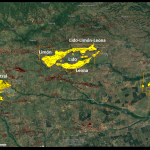

Location of Fields: The six fields are situated onshore in the states of Anzoategui and Monagas in Eastern Venezuela.

-

Size of Land Package: The total area of these onshore fields in Venezuela covers 794.2 square kilometers.

-

Historical Production: These fields were last active in 2015, with production averaging around 800 to 1,000 barrels of oil equivalent per day (boepd). Notably, with adequate investment, these fields achieved a peak production of approximately 60,000 boepd in 1960.

-

Reactivation Program: New Stratus plans to make a substantial investment to reactivate up to 246 wells in these fields.

-

Duration of Rights: The current oil production rights have an initial term that concludes in December 2035. There are plans to apply for an extension of these rights until 2050.

-

Credit Facility Details: GoldPillar is set to provide a six-month €60 million revolving line of credit to Vencupet. This facility will span four and a half years, with the indirect maximum capital exposure for New Stratus Energy at any given time estimated to be approximately US$25 million.